Stacks Treasury Committee: December 2025 Community Update

As 2025 comes to a close, the Stacks Treasury Committee (TC) met to align ahead of the new year. This session marked a milestone in strengthening the governance, financial stewardship, and long-term sustainability of the Stacks ecosystem — and reaffirmed our collective focus on building the Bitcoin economy.

Summary

What We Reviewed: The Treasury Committee (TC) met as a full quorum for the first time to review the operational progress since SIP-031, the 2026 budget proposal, the current treasury strategy, and the ecosystem’s broader strategic direction.

What Was Approved: The TC approved a $27M 2026 operating budget and a 25M STX working-capital allocation, endorsed updated category allocations reflecting current market conditions, and aligned on a disciplined capital-deployment approach prioritizing engineering, security, core growth programs, and sustainable DeFi liquidity.

Why the budget evolved: Adjustments were required due to macro headwinds, STX price, and the reality that engineering, security, and treasury-management functions are fixed baseline costs. Additional budget was reallocated toward security and DeFi working capital to ensure safe deployments and bootstrap liquidity flywheels.

How We’ll Communicate Going Forward: Starting in 2026, the Endowment and TC will host monthly public office hours, formal updates after each Board meeting, and publish all office hour times on the Stacks Ecosystem Calendar. We aim to provide recurring visibility into operations, budget execution & strategy, and ecosystem progress.

Understanding the Stacks Endowment and Stacks Treasury Committee Board

The Stacks Endowment is the new foundation that holds our long-term treasury and has an advisory board, the Stacks Treasury Committee, which provides community input and oversight. The Endowment exists to serve the ecosystem and its community.

The Stacks Endowment focuses on maintaining and growing Stacks’ long-term treasury. Its mission is to ensure the ecosystem’s financial engine runs sustainably for years to come. Within the Stacks Endowment is Stacks Labs. Stacks Labs is the operating entity for the ecosystem, focusing on blockchain development, product, R&D, marketing, partnerships, developer relations, and growth.

The Treasury Committee represents the Stacks community’s interests — approving how funds are allocated, voicing community concerns, and providing feedback on strategic direction. The Treasury Committee members were selected by an Appointments Committee that prioritized diverse backgrounds of folks building and supporting Stacks. This nine-member group represents the full range of Stacks, ensuring that no voice is left behind.

Strategic Direction: How Stacks Wins

A key discussion theme was differentiation — how Stacks can continue to differentiate itself as it continues its mission to activate the Bitcoin economy. Since its inception, Stacks has positioned itself as Smart Contracts for Bitcoin, a Bitcoin scaling solution, and the leading Bitcoin layer.

Stacks’s strategic vision is to be the default place for the BTC economy to live onchain. We picture a world where hundreds of billions in BTC are deployed via sBTC, millions of daily sBTC-related transactions (staking, payments, yield products, and DeFi) on Stacks. We want to provide the functionality that Bitcoin itself doesn’t (and shouldn’t) have, without compromising the principles that make Bitcoin the ultimate store of value. A deeper dive on this will be shared in the coming weeks, highlighting where market research shows clear demand that Stacks is uniquely positioned to serve.

Core Focus Areas for 2026

- Self Custodial minting, payments, and privacy through sBTC

- Self Custodial Bitcoin Staking, allowing users to earn Bitcoin yield through a combination of locked Bitcoin (on the L1) and STX (on the L2).

- Growth + Utilization through deepening liquidity, incentives, and curating vault products.

- Expanded high-impact partnerships like Wormhole, new fiat onramps, institutional custodians, cross-chain wallets, and exchange-related SIP 010 token integrations for ecosystem TGEs

Progress Post SIP-031

It’s been an eventful period since the community approved SIP 031, which set the framework for the Stacks Endowment. Much of 2025 was about turning that proposal into a living, operational reality.

Highlights include:

Entity Operations - The Stacks Endowment and Stacks Labs are now fully established and operating as one aligned team. Core operations, including banking, custody, onboarding, legal frameworks, and tax compliance, have been completed, bringing structure and resilience to day-to-day operations.

People & Hiring - Recruitment is underway for two key leadership roles — a Chief Marketing Officer to guide Stacks' growth under a global brand strategy and a Chief Investment Officer to steward treasury investment and risk management.

Community & Engagement - In partnership with the Stacks Foundation, interim grants have been awarded to builders to bridge program funding gaps until Stacks Endowment launches the new program in January 2026. Other community events, such as Code4STX and Stacks Ascent, saw expansion, leading to many developers being invited to the Dev Connect Hackerhouse. These programs led Stacks to become the #5-fastest-growing developer community, according to Electric Capital’s Developer Report.

Product & Partnerships - Engineering and product teams have been working relentlessly to uncap sBTC, launch Dual Stacking, release Clarity 4, and improve the chain health. Additionally, the team has expanded the sBTC UI, updated Stacks Explorer, and completed the integration of WalletConnect (Reown). Current EOY priorities include launching USDCx in collaboration with Circle, testing the Wormhole integration, and Clarity-WASM improvements. From a partnerships perspective, sBTC has been listed on two major centralized exchanges (Gate, MEXC), and an onchain market maker has been sourced to improve spreads and depth on DEXs and CEXs.

2026 Budget Overview

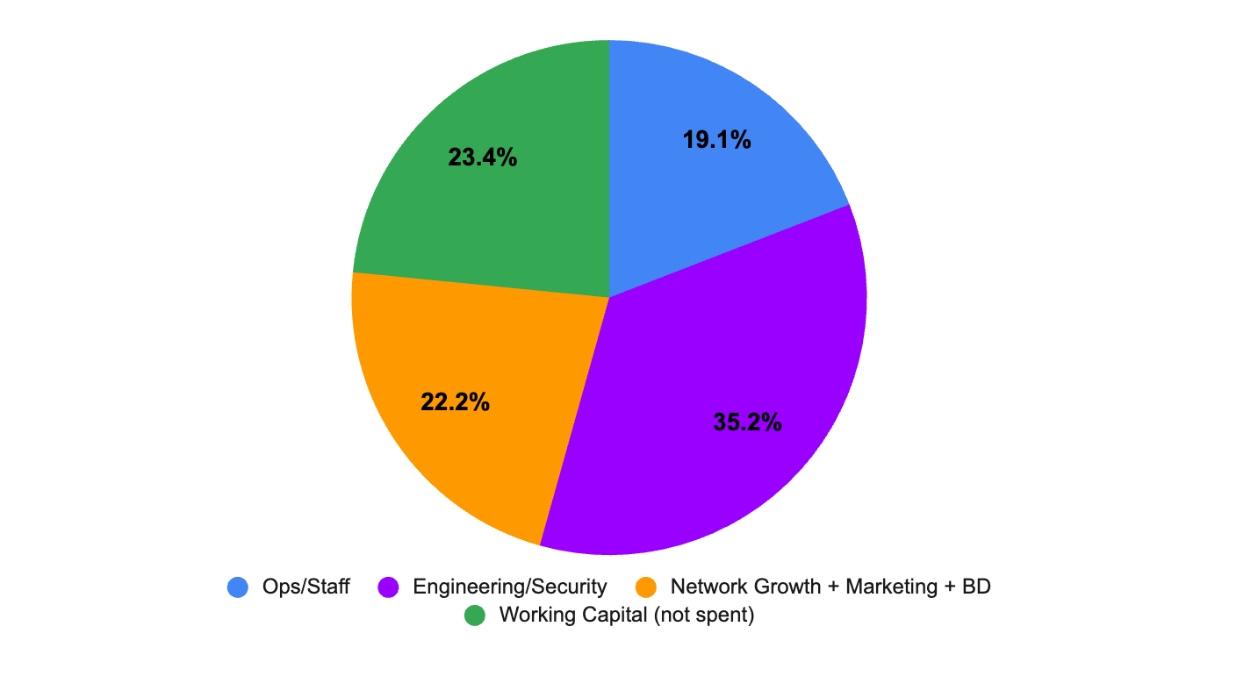

The Endowment presented and received approval for a 2026 annual budget of $27 million, with a separate working capital allocation of 25 million STX for DeFi deployment. At a high level, the budget follows the general categories outlined in SIP 031.

The 2026 Budget differs from the SIP 031 draft initial allocations, reflecting current macro market conditions and the immediate needs of the ecosystem. Relative to the SIP ratios, the ratio of this approved budget is different because engineering and security are somewhat ‘fixed costs’ that must happen regardless. If macro conditions change, a larger share of the additional capital can be deployed in areas like network growth to bring these ratios back into line. We’re spending more on Working Capital (Bitcoin DeFi) to bootstrap our flywheel. Given that the Endowment will deploy the ecosystem’s treasury into Stacks DeFi, it was prudent to increase the security budget for DeFi teams to seek contributions for critical bugs in ImmuneFi or for enhanced security audits.

Although the marketing allocation is conservative for early 2026, this is intentional. A CMO search is underway, and the focus is to preserve flexibility so the new leader has meaningful resources to deploy. The TC emphasized running selective, high-signal KOL and user-acquisition experiments while avoiding large, high-cost activations in a challenging macro environment. The strategy is to give the market what it’s ready for today, while preparing to scale quickly when conditions improve, and Stacks enters a stronger breakout phase.

In parallel, Stacks Labs is launching new initiatives to strengthen the top of the funnel. These include high-impact user-growth campaigns tied to major product launches, expanded starter grants to attract new builders, and increased investment in upcoming Stacks Accelerator cohorts. Even in a conservative macro environment, these programs position Stacks to consistently bring in new users, new developers, and new high-quality teams.

Lastly, we want to emphasize the creation of a new, rebooted Stacks Grant program. Community and dApp support is a top priority for the TC, with the treasury reinvested in the community we serve. At a high level, the Grants program will have three tracks for funding: (1) Necessary, (2) Getting Started, and (3) Community Selected.

- Necessary grants will cover liquidity mining incentives, user acquisition incentives, high-impact integrations, essential feature requests, and resourcing for audits & security.

- Getting started grants give funding to launch a proof of concept for pre-product market fit builders.

- Community-selected grants will follow the spirit of Degrants, focusing on exploratory initiatives that strengthen the ecosystem’s social, cultural, or educational fabric.

The Grants program will be open for applications in January 2026.

Navigating a Tough Macro Environment

The Treasury Committee acknowledged the reality of today’s broader market as reflected in STX's price. In the current macro environment, the Treasury Committee must make hard, disciplined decisions about where capital is spent.

That means focusing resources on programs that deliver the highest impact and measurable outcomes — while temporarily throttling others appropriately and sequencing programs that can hit in these conditions. This doesn’t mean cutting initiatives altogether; it means prioritizing sustainability and strategic value over breadth.

- Continuing to fund security and DeFi infrastructure.

- Scaling growth (accelerator & grants) programs to plant the seeds for new builders and users in Stacks

- Deploying in DeFi and offering as much in incentives as we can

- Deferring larger activations & partnerships and “wish list” items until market conditions improve.

This conservative stance protects the treasury and positions Stacks for durable growth when macro tailwinds return.

Treasury Position

To ensure sufficient funding for the initiatives, the Endowment is taking the following measures to safeguard Stacks' long-term treasury and provide adequate operating capital.

- The Endowment sells STX through locked, private OTC sales to avoid market-price impacts for the first year. These sales will be structured with multi-month lockups to strategic investors who are already mission-aligned to Stacks.

- With a portion of sales proceeds, the Endowment will purchase sBTC and stablecoins to diversify the treasury and support other working capital allocations. This will support our short-term treasury operations.

- For long-term treasury operations, the Endowment’s two-year goal is to generate enough risk-adjusted yield and strategic income to fund operations sustainably, balancing risk and return in a volatile market. This includes derivative option strategies, STX token buy-backs, and continuous deployments in Stacks DeFi for yield.

Community Engagement

A key focus for the Endowment and Treasury Committee going forward is deepening its relationship with the community through open communication and consistent transparency. We plan to hold monthly informal office hours in collaboration with the Treasury Committee as touchpoints for dialogue and feedback, complemented by quarterly formal updates that summarize key decisions and financial insights. All meetings will be published on the Stacks Ecosystem Calendar, hosted on X Spaces. These conversations will have representatives from TC and Endowment who will provide updates on progress, priorities, and initiatives.

Looking Ahead to 2026

We look forward to supporting Stacks Labs in publishing the “north star” goals of Stacks across product, engineering, marketing, and growth so that each member of the community feels they are running toward the same strategic objectives.

The Stacks Forum will remain the primary space for the community to convene, propose ideas, and help shape new initiatives. To make participation even easier, we have created a simple Forum template that guides contributors to meaningfully contribute to the ecosystem’s roadmap.

Even amid a challenging macro environment, the mission remains unchanged: to make Bitcoin productive and to ensure the Stacks ecosystem grows with transparency, sustainability, and shared purpose.

Onwards!

Get more of Stacks

Get important updates about Stacks technology, projects, events, and more to your inbox.

.png)