USDCx Launches on Stacks: Bitcoin Gets Its Top Tier Stablecoin

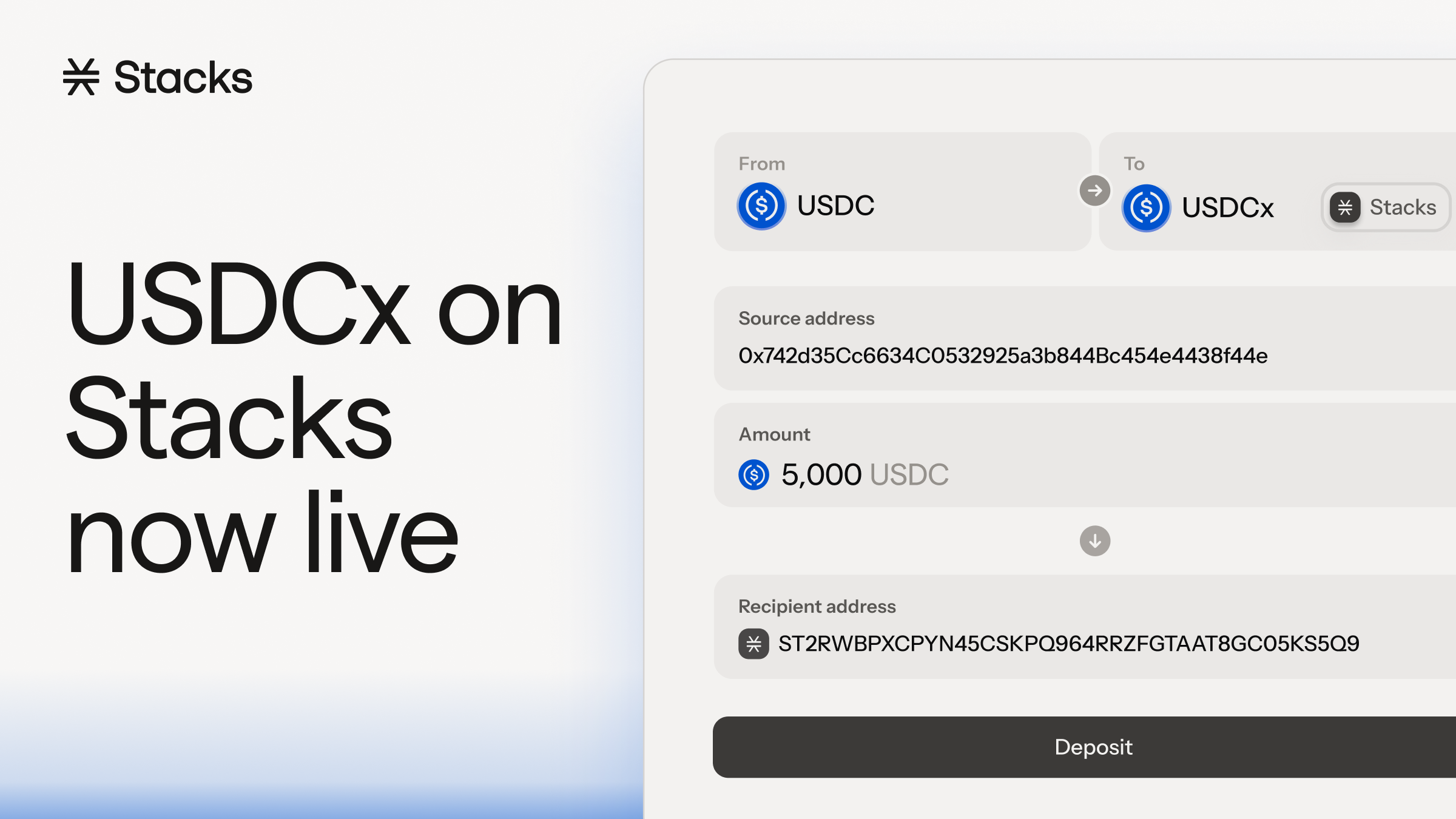

In November, we announced Stacks’ integration with Circle’s new xReserve infrastructure. Today, that work is complete. USDCx on Stacks is a USDC-backed stablecoin that plugs directly into Circle’s multichain ecosystem and brings stable, interoperable liquidity to Bitcoin’s leading Layer 2.

What is USDCx?

USDCx is a USDC-backed stablecoin issued through Circle xReserve and native to Stacks. xReserve provides cryptographic attestations for deposits and minting, while Circle Gateway and CCTP handle crosschain movement. The result is USDCx on Stacks, interoperable with USDC across supported chains, without third-party bridges, wrapped assets, or fragmented liquidity.

Why USDCx Matters for Bitcoin DeFi

Stablecoins are the foundation of productive capital markets. USDCx on Stacks enables lending, borrowing, and trading without forcing users to step out of the Bitcoin economy.

USDCx on Stacks is a USDC-backed, cryptographically attested stablecoin that moves across chains through Circle’s native infrastructure. It works everywhere USDC works, from Ethereum to Solana and beyond, all while settling on Bitcoin through Stacks.

With USDCx on Stacks, developers get a reliable dollar rail to build with, users get predictable liquidity, and protocols get a widely-adopted base asset for markets and collateral. It provides the missing piece for deeper liquidity, healthier markets, and real Bitcoin-denominated yield.

How Apps on Stacks Are Preparing for USDCx

USDCx is supported by major ecosystem wallets Asigna, Fordefi, Leather and Xverse.

Leading DeFi Apps on Stacks will begin integrating USDCx into their protocols. Users can expect full USDCx support across the Stacks ecosystem in early Q1. Here’s a preview of what’s to come:

• Zest Protocol is integrating USDCx into its multi-asset lending pools, giving institutional lenders a stable, trusted dollar asset for Bitcoin credit markets.

• Granite will enable users to borrow USDCx against their Bitcoin, non-custodially, with BTC staying in wallets and community-powered liquidations protecting positions.

• Bitflow is launching USDCx trading pairs and liquidity pools, bringing deeper stablecoin liquidity to Stacks DEXs and connecting traders to Circle’s cross-chain USDC rails.

This marks the start of a broader shift: Bitcoin liquidity meeting stable, programmable dollars.

Getting Started

For Stacks users: Acquire USDCx through the official bridge app and migrate your aeUSDC into USDCx to take advantage of better liquidity and improved trust assumptions.

At launch, the USDCx bridge on Stacks supports transfers between Ethereum and Stacks. The first aeUSDC–USDCx liquidity pool will be available on Bitflow in early January.

Support for additional Circle / CCTP-compatible networks is on the roadmap and will roll out in Q1 2026, enabling broader interoperability across Circle’s multichain USDC ecosystem.

For Stacks developers: Integration guides are available in the Stacks developer documentation. You can start building with USDCx today using Circle’s xReserve and CCTP infrastructure.

What This Unlocks

Bitcoin has always been an open financial infrastructure. Now it finally has a programmable stablecoin to match that moves across chains and settles on Bitcoin.

With USDCx live on Stacks, the next chapter of Bitcoin DeFi can be built on top of it.

Get more of Stacks

Get important updates about Stacks technology, projects, events, and more to your inbox.

.png)